Got a Project?

Share the details of your project - like scope, timeframes, or business challenges. Our team will thoroughly review the materials and respond to you promptly.

An OKX Clone Script is a complete crypto exchange platform foundation that enables digital asset trading through a centralized system. It manages order placement, trade execution, wallet balances, and operational controls required to run spot and derivatives markets safely. It is structured for business use, offering customization in user access rules, supported cryptocurrencies, transaction fees, and interface layout. OKX Clone is designed to function consistently across desktop and mobile environments for traders and administrators to operate without performance gaps or workflow inconsistencies.

Unlike surface-level exchange clones, this OKX crypto exchange clone script is designed around core exchange mechanics such as order priority handling, wallet reconciliation accuracy, and operational control. Each component is structured to support continuous trading.

Administrators can manage users, assets, trading pairs, fees, and system parameters through a controlled backend interface.

Our OKX Clone Script supports spot markets, perpetual swaps, and futures trading within a single system.

The matching engine processes large volumes of buy and sell orders with low latency, maintaining execution accuracy during volatility.

Integrated wallets handle deposits, withdrawals, and internal transfers across supported cryptocurrencies, with wallet separation for security.

Users can fund accounts through supported cryptocurrencies or integrated fiat gateways, based on regional compliance and availability.

Crypto exchange platforms like OKX include tiered identity verification, withdrawal limits, and transaction monitoring.

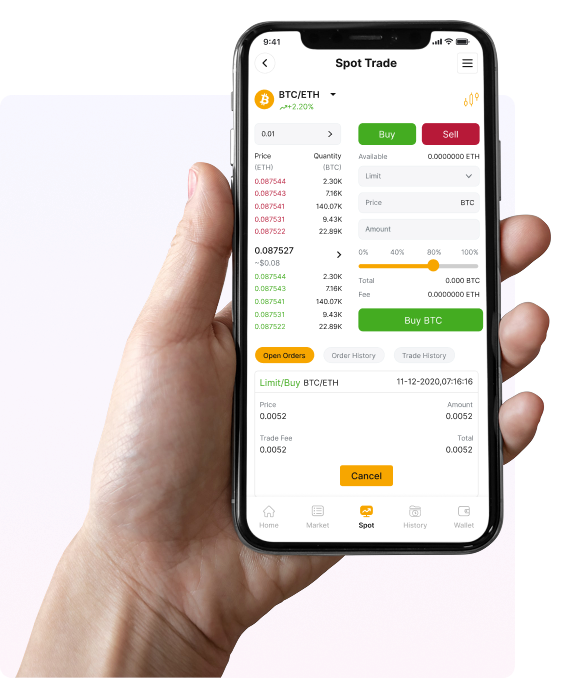

Fully responsive mobile app support for Android/iOS ensures traders can manage positions anytime with a clear UI optimized for accuracy.

Our OKX clone software is built as a feature-rich trading system, and each layer is designed for auditability and controlled expansion without interrupting active cryptocurrency markets.

Secure Account Setup and Login Protection

Spot and Derivatives Trading Access

Advanced Order Placement Options

Multi-Chain Wallet and Asset Tracking

Live Market Data and Trade History

API Access for Automated Strategies

Trading Pair and Market Management

Fee and Commission Configuration

Liquidity and Market Activity Monitoring

User Control and Risk Handling

Compliance and Verification Settings

Operational and Revenue Reporting

Multi-Signature Wallet Management

Encrypted Storage and Data Transfers

IP Address and Device Monitoring

Withdrawal Control Mechanisms

System Activity and Trade Logging

Compliance-Ready Audit Trails

Operating a crypto exchange platform like OKX requires consistent order execution, real-time margin enforcement, and accurate wallet reconciliation under heavy load. Our platform is architected with isolated core services to maintain system integrity and operational control.

The platform handles heavy order flow with consistent execution, ensuring reliability during peak market activity and sudden price movements.

Built-in support for futures and perpetual contracts includes margin handling, leverage controls, and position lifecycle management.

Pre-developed trading, wallet, and admin components reduce setup time while maintaining production-level system behavior.

Detailed logs, user activity tracking, and financial reports support accountability and regulatory readiness.

With our OKX clone script, admins can manage leverage limits, liquidation rules, and exposure settings from a single control layer.

The OKX clone app supports income from trading fees, withdrawals, asset listings, and optional premium trading services.

New cryptocurrencies, trading pairs, and infrastructure resources can be added without disrupting active markets..

API access allows connections with liquidity providers, trading bots, and institutional partners in the OKX cryptocurrency exchange platform

Our crypto exchange platform like OKX operates through a controlled sequence of system actions that maintain trading accuracy, wallet consistency, and risk enforcement across all user activity.

Users create accounts and complete configured verification checks, enabling controlled access based on compliance and risk policies

Once verified, system wallets are generated, and users fund their accounts through supported crypto deposits or approved fiat channels.

Users access available spot or derivatives markets, where trading rules, leverage limits, and fees are applied automatically.

Buy and sell orders enter the matching engine, which processes them in real time according to price, time priority, and market conditions.

Executed trades trigger immediate balance updates, fee deductions, and position adjustments within the wallet system.

Automated tools monitor exposure, margin usage, and abnormal activity to enforce platform rules continuously.

Users can withdraw available balances or continue trading without interruption, subject to security and approval policies.

Using a white-label OKX clone script provides a fast track to establishing a dominant cryptocurrency exchange under your unique brand identity. This strategic solution eliminates the complexities of building infrastructure from scratch, allowing you to focus on aggressive marketing and user acquisition to generate immediate revenue. By leveraging a scalable and secure trading platform, you capture significant market share and build trust among global traders. This approach minimizes growth risks while maximizing profit potential through various monetization streams. Ultimately, a white-label solution empowers your business to compete instantly with top-tier exchanges, ensuring rapid growth and long-term sustainability in the competitive crypto market.

Our OKX clone app extends core exchange operations to Android and iOS environments without limiting trading functionality. The app supports real-time spot and derivatives trading, wallet balance management, open position tracking, and live market data access. Trading actions in the software are processed through secure API layers with consistency between mobile and web platforms. The application includes biometric authentication, encrypted communication channels, and session controls to protect user accounts. The interface prioritizes order accuracy, fast navigation, and fast notifications during market movements.

We built the OKX crypto exchange platform with careful coordination between trading logic, wallet accuracy, and operational controls, reducing technical risk while preparing the platform for real trading activity from day one.

We begin by identifying supported cryptocurrencies, market types such as spot and derivatives, fee models, and jurisdiction-specific compliance rules.

Trading engines, wallet interactions, API layers, and user access flows are structured to ensure consistent behavior across all exchange functions.

Order matching, balance updates, escrow logic where applicable, and external integrations are implemented and aligned with defined trading rules.

Account protection, transaction monitoring, withdrawal controls, and compliance checks are configured to safeguard funds and platform activity.

Simulated trading scenarios are used to validate execution speed, wallet reconciliation, and system stability during high-volume conditions.

Our OKX clone script is deployed with monitoring in place, followed by continuous technical support, upgrades, and optimization.

The OKX exchange clone is built to generate predictable revenue from core trading activity, and revenue mechanisms are integrated directly into trading, wallet, and API workflows for transparent fee collection and accurate reporting.

We follow a structured approach to develop and deploy your crypto trading platform like OKX

We begin by identifying supported cryptocurrencies, market types such as spot and derivatives, fee models, and jurisdiction-specific compliance rules.

Trading engines, wallet interactions, API layers, and user access flows are structured to ensure consistent behavior across all exchange functions.

Order matching, balance updates, escrow logic where applicable, and external integrations are implemented and aligned with defined trading rules.

Account protection, transaction monitoring, withdrawal controls, and compliance checks are configured to safeguard funds and platform activity.

Simulated trading scenarios are used to validate execution speed, wallet reconciliation, and system stability during high-volume conditions.

Our OKX clone script is deployed with monitoring in place, followed by continuous technical support, upgrades, and optimization.

Yumeus approaches OKX Clone Software development work with clear responsibility for operational outcomes and upgrade handling directly for user trust and regulatory posture. We concentrate on how the exchange behaves under real trading conditions rather than how it appears on launch with a predictable, auditable, and maintainable OKX cryptocurrency exchange platform.

The trading engine and supporting services are built to manage concurrent order submissions, cancellations, and executions.

Protection is applied across wallet operations, user authentication, API access, and administrative actions to reduce exposure.

Configuration changes such as asset updates, fee adjustments, or policy changes are applied while the platform preserves trade continuity.

Both trader-facing and admin interfaces come with clear status indicators, balances, and confirmations to limit misinterpretation.

Ongoing involvement includes monitoring system behavior, applying performance improvements, and assisting with new integrations.

Propel Your Revenue To New Heights And Dominate The Global Crypto Market With A Supreme Trading Solution. Start Now To Capture Millions Of Active Traders Using Our Robust OKX Clone Script. Convert High Volumes Of Traffic Into Massive Profits And Establish Your Digital Empire Today!

An OKX Clone Script is a pre-built software framework that replicates core trading and account features of the OKX exchange, for entrepreneurs to launch a similar platform quickly and reliably.

It usually includes multi-coin wallets, spot and futures trading, order books, KYC/AML modules, liquidity integration, real-time price feeds, and security protections like two-factor authentication.

Yes, most scripts allow you to modify the design, layout, trading tools, supported coins, and dashboard features so your platform suits your business needs.

Liquidity is often managed by connecting to external liquidity providers or APIs so your order books remain active and users enjoy smooth trade execution.

An advanced clone should offer measures like two-factor authentication, encryption, cold wallet storage, DDoS mitigation, and continuous monitoring to help safeguard user funds.

Deployment time varies based on features and customization, but with a ready script, most projects reach live launch within a few weeks, compared to months for custom builds.

Share the details of your project - like scope, timeframes, or business challenges. Our team will thoroughly review the materials and respond to you promptly.